As real estate investors search for the best investment opportunities, many are turning to Airbnb as a potential source of returns. With the number of Airbnb listings growing exponentially, it can be difficult to determine which properties will yield the highest returns. To help investors make the best decisions, we’ve compiled a list of the top Airbnb investment questions. Whether you’re a first-time investor or an experienced pro, this guide will help you understand the key considerations for a successful Airbnb investment.

What Are the Most Important Questions to Ask When Considering an Airbnb Investment?

When looking to invest in Airbnb, there are a number of questions you should be asking yourself before making a commitment. From understanding the legal implications of such an investment to researching the local market, there are a number of factors to consider before taking the plunge. In this article, we look at the most important questions to ask when considering an Airbnb investment.

What Are the Legal Implications?

The legal implications of investing in Airbnb can vary from country to country. For example, some countries may require that the property is registered with the local authority, or that you have the necessary insurance in place. It is important to understand the local laws and regulations to ensure that you are operating legally. It is also worth researching any tax implications of your investment.

What Are the Local Market Conditions?

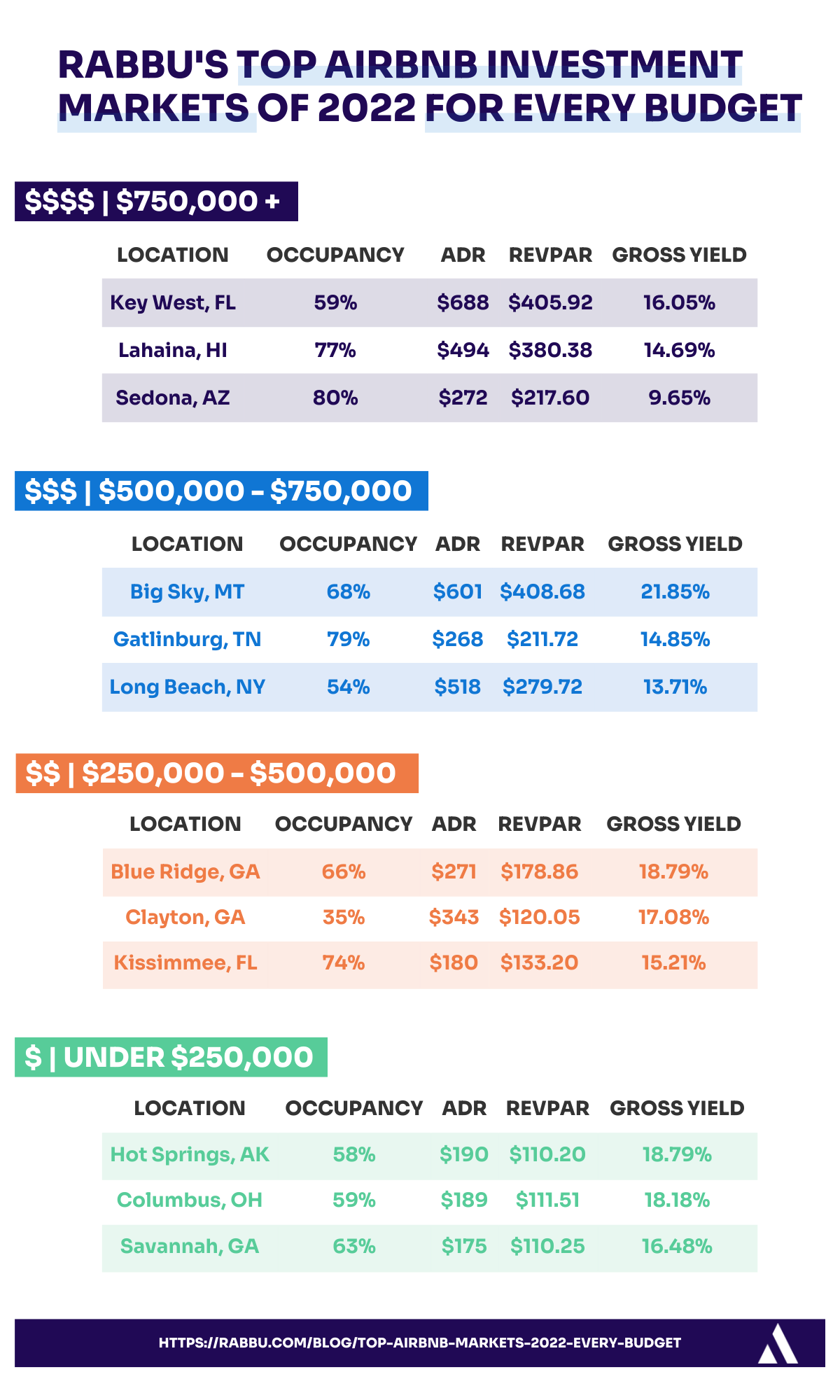

Before investing in Airbnb, it is important to understand the local market conditions. Research the area to find out what type of properties are in demand and what the average rental rates are. It is also worth taking a look at the competition to get an idea of what the competition is like.

How Will I Find Guests?

Once you have found the right property, the next step is to find guests. There are a number of ways to do this, including using online platforms such as Airbnb, VRBO, and HomeAway. It is also worth looking into marketing strategies such as pay-per-click advertising and social media campaigns.

What Are the Costs Involved?

Before investing in Airbnb, it is important to understand the costs involved. There are a number of costs associated with investing in Airbnb, such as insurance, taxes, maintenance, and any necessary renovations. It is also important to factor in any fees charged by the online platform you use to find guests.

What Are the Potential Risks?

Investing in Airbnb does come with some risks, such as the possibility of short-term vacancies or tenants who may not pay their rent on time. It is important to research the local market and understand the potential risks before making a commitment.

How Can I Maximize Profits?

Once you have found the right property, it is important to maximize your profits. This can be done by offering additional services such as cleaning, linen hire, and airport transfers. It is also important to stay on top of local market conditions to ensure that you are pricing your rental competitively.

What Are the Benefits?

Investing in Airbnb can offer a number of benefits, such as the potential to generate a passive income and the ability to build a diverse portfolio. It can also offer a great opportunity to meet new people from around the world.

What Are the Challenges?

Investing in Airbnb can come with a number of challenges, such as the need to constantly monitor the local market conditions and to stay on top of the legal requirements. Finding guests can also be a challenge, as can dealing with difficult tenants.

How Can I Ensure a Positive Experience?

To ensure a positive experience for both you and your guests, it is important to provide a professional service. This includes responding quickly to any queries and ensuring that the property is well-maintained and clean. It is also important to ensure that you have the necessary insurance in place.

Top 6 Frequently Asked Questions

What Are the Benefits of Investing in Airbnb?

Answer: Investing in Airbnb has several benefits, including high returns, flexibility, and passive income potential. Airbnb investments tend to have higher returns than traditional rental properties, as Airbnb rental rates are typically higher than those of long-term rentals. Additionally, Airbnb investments provide more flexibility for investors, as you can choose the level of involvement you would like to have in managing your property and the length of rental periods. Airbnb investments also have the potential to generate passive income, as Airbnb hosts can rent their properties on a short-term basis without having to manage the property themselves.

What Are the Risks of Investing in Airbnb?

Answer: While investing in Airbnb can be a great way to generate passive income, there are some risks that investors should be aware of. Airbnb investments rely on the availability of local customers, so investors should be aware of changing local market conditions and what that could mean for their investments. Additionally, Airbnb investments can be subject to high turnover rates and increased maintenance costs, as most short-term rental properties require more frequent maintenance and cleanings than long-term rental properties. Lastly, Airbnb hosts are subject to local regulations, so investors should make sure to familiarize themselves with local laws and regulations regarding short-term rentals.

What Are the Tax Implications of Investing in Airbnb?

Answer: Investing in Airbnb can have several tax implications for investors, depending on their specific circumstances. Airbnb hosts may be subject to local, state, and federal taxes, including income tax, self-employment tax, and sales tax. Additionally, Airbnb hosts may be required to pay occupancy taxes and other fees, such as cleaning fees, in some jurisdictions. Airbnb hosts should also be aware of potential tax deductions they may be eligible for, such as deductions for travel expenses, advertising expenses, and supplies.

How Can I Minimize the Risk of Investing in Airbnb?

Answer: There are several steps investors can take to minimize the risk of investing in Airbnb. First, investors should research their local market to determine the demand for short-term rentals in their area. Additionally, investors should be sure to familiarize themselves with local laws and regulations regarding short-term rentals, and make sure to obtain any necessary permits or licenses before listing their property on Airbnb. Lastly, investors should create a plan for managing their property, including maintenance and cleaning plans, to ensure their property is in good condition and attractive to potential renters.

What Should I Consider When Choosing an Airbnb Investment Property?

Answer: When choosing an Airbnb investment property, there are several factors investors should consider. Location is key when it comes to Airbnb investments, as investors should choose a property in a desirable area with a high demand for short-term rentals. Additionally, investors should research local laws and regulations regarding short-term rentals, and make sure to obtain any necessary permits or licenses before listing their property on Airbnb. Lastly, investors should consider the amenities they would like to offer to potential renters, as these amenities can help attract more customers and increase rental rates.

How Can I Increase the Rental Rates of My Airbnb Investment Property?

Answer: There are several ways investors can increase the rental rates of their Airbnb investment property. First, investors should ensure their property is in good condition and well-maintained, as this can help attract more customers and increase rental rates. Additionally, investors can offer amenities such as in-unit laundry or a fully-equipped kitchen to make their property more attractive to potential renters. Lastly, investors should research the local market to make sure they are charging a competitive rate for their property.

Airbnb Business – Most Frequently Asked Questions

In conclusion, investing in Airbnb properties can be a great way to make money and create a profitable business. However, it is important to educate yourself on the best Airbnb investment questions to ensure success. As an investor, it is important to ask questions such as: What is the best location for an Airbnb property? What are the tax implications of Airbnb investments? What kind of returns can I expect? What kind of insurance do I need? Answering these questions can help you make an informed decision and ensure a successful Airbnb investment.