As the popularity of Airbnb continues to grow, more and more people are turning to the platform to rent out their homes and earn some extra income. However, it’s important to remember that with income comes taxes. Whether you’re a seasoned Airbnb host or just starting out, it’s crucial to understand how to properly add taxes to your Airbnb listing in order to avoid any legal or financial issues down the line.

Fortunately, adding taxes to your Airbnb listing is a relatively simple process. In this article, we’ll walk you through the steps you need to take to ensure that you’re collecting and remitting the correct amount of taxes on your Airbnb rental. From understanding the different types of taxes that may apply to your rental, to setting up your Airbnb account to collect taxes automatically, we’ll cover everything you need to know to stay compliant and keep your Airbnb business running smoothly. So, if you’re ready to take your Airbnb rental to the next level, let’s dive in!

How to Add Taxes to Airbnb Listing?

To add taxes to your Airbnb listing, follow these simple steps:

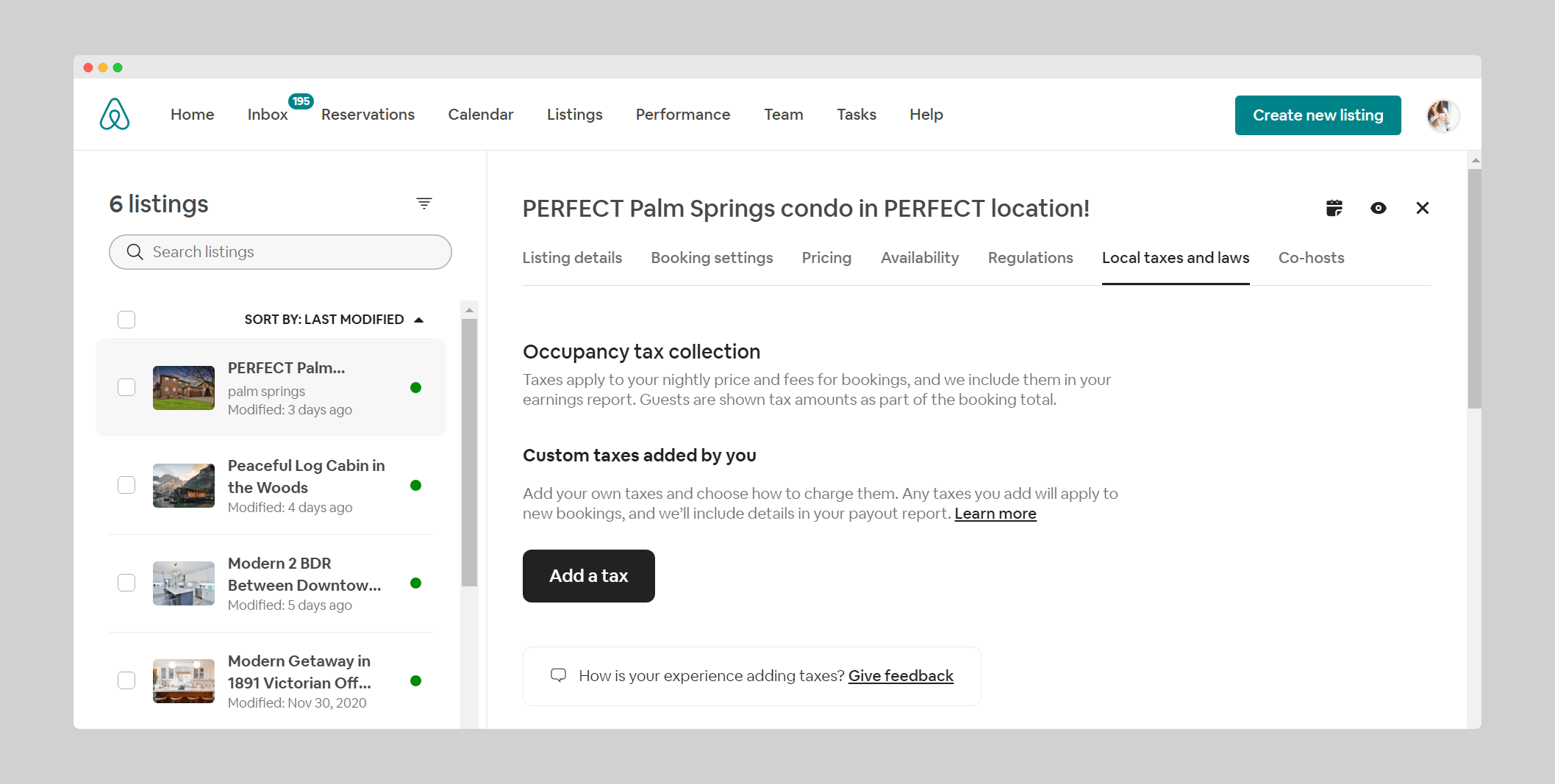

- Log in to your Airbnb account and go to your listings.

- Select the listing you want to add taxes to and click on the “Pricing” tab.

- Scroll down to the “Taxes” section and click on “Add tax.”

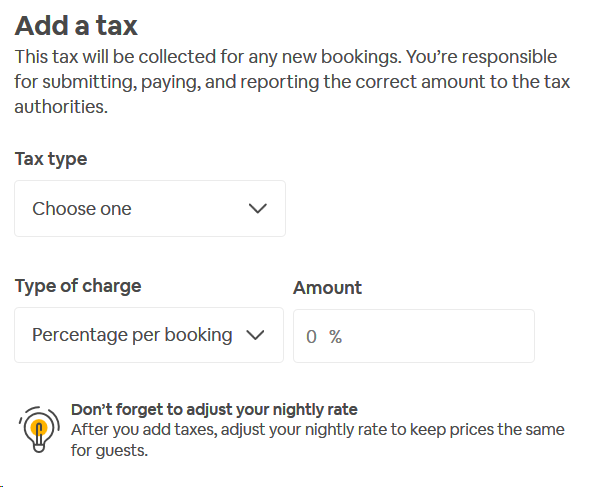

- Select the type of tax you want to add and enter the percentage rate.

- Save your changes and your taxes will be added to your listing.

How to Add Taxes to Airbnb Listing?

Are you an Airbnb host looking to add taxes to your listing? As a responsible host, it is important to include taxes in your rental rates to avoid any future legal or financial issues. In this article, we will guide you through the process of adding taxes to your Airbnb listing, step by step.

Step 1: Determine Your Tax Obligations

The first step in adding taxes to your Airbnb listing is to determine your tax obligations. This may vary depending on your location and the laws of your state or country. It is important to do your research and consult with a tax professional to ensure that you are in compliance with all relevant tax laws.

Once you have determined your tax obligations, you can add the appropriate tax rate to your listing. You can do this by going to the “Pricing” section of your Airbnb dashboard and clicking on “Taxes and Fees”. Here, you can enter your tax rate and choose whether you want to apply it to your nightly rate, cleaning fee, or both.

Step 2: Communicate Clearly with Guests

It is important to communicate clearly with your guests about any taxes or fees that may be included in their rental rate. You can do this by including a message in your listing description or in your communication with guests.

Make sure to clearly state the tax rate and how it will be applied to their rental rate. This will help avoid any confusion or misunderstandings later on.

Step 3: Keep Accurate Records

As a host, it is important to keep accurate records of any taxes collected from guests. This will help you stay organized and compliant with tax laws.

You can use Airbnb’s reporting tools to track your tax collections and download reports for your records. It is also a good idea to consult with a tax professional for guidance on record-keeping.

Step 4: Benefits of Adding Taxes to Your Airbnb Listing

There are several benefits to adding taxes to your Airbnb listing. First, it helps you stay compliant with tax laws and avoid any legal or financial issues down the line.

Additionally, adding taxes to your rental rate can help you earn more revenue. Many guests are willing to pay a slightly higher rate if they know that taxes are included and they won’t be hit with any surprise fees.

Step 5: Pros and Cons of Adding Taxes to Your Airbnb Listing

While there are many benefits to adding taxes to your Airbnb listing, there are also some potential drawbacks to consider.

One potential con is that adding taxes may make your rental rate appear higher than other listings in your area. This could make it harder to attract guests, especially if they are price-sensitive.

Another potential con is that guests may not understand why they are being charged extra for taxes. This could lead to confusion or complaints, which could negatively impact your ratings and reviews on Airbnb.

Step 6: Alternatives to Adding Taxes to Your Airbnb Listing

If you decide that adding taxes to your Airbnb listing is not the right choice for you, there are some alternative options to consider.

One option is to include taxes in your cleaning fee instead of your rental rate. This will help you stay compliant with tax laws while keeping your rental rate competitive.

Another option is to offer a discount to guests who pay in cash, since you won’t have to pay taxes on cash payments. However, this option may not be feasible for all hosts and may not be worth the potential legal or financial risks.

Step 7: Conclusion

Adding taxes to your Airbnb listing is an important step in being a responsible and compliant host. By following the steps outlined in this article, you can ensure that you are in compliance with tax laws and avoid any future legal or financial issues.

Remember to communicate clearly with guests about any taxes or fees that may be included in their rental rate, keep accurate records of tax collections, and consider the benefits and drawbacks of adding taxes to your listing.

Step 8: Additional Resources

If you need more information on adding taxes to your Airbnb listing, here are some additional resources to check out:

– Airbnb’s tax collection and remittance guide

– IRS small business and self-employed tax center

– State and local tax resources for Airbnb hosts

Step 9: FAQs

Q: Do I have to add taxes to my Airbnb listing?

A: It depends on your location and tax laws. It is important to do your research and consult with a tax professional to ensure that you are in compliance with all relevant tax laws.

Q: How do I add taxes to my Airbnb listing?

A: You can add taxes to your Airbnb listing by going to the “Pricing” section of your Airbnb dashboard and clicking on “Taxes and Fees”. Here, you can enter your tax rate and choose whether you want to apply it to your nightly rate, cleaning fee, or both.

Q: What are the benefits of adding taxes to my Airbnb listing?

A: Adding taxes to your Airbnb listing helps you stay compliant with tax laws and avoid any legal or financial issues down the line. It can also help you earn more revenue by attracting guests who are willing to pay a slightly higher rate for a listing with taxes included.

Step 10: Final Thoughts

Adding taxes to your Airbnb listing may seem like a daunting task, but it is an important step in being a responsible and compliant host. By following the steps outlined in this article and consulting with a tax professional if needed, you can ensure that you are in compliance with tax laws and avoid any future legal or financial issues.

Frequently Asked Questions

Adding taxes to your Airbnb listing can be a bit tricky. Here are some frequently asked questions that will help you add taxes to your Airbnb listing.

What taxes do I need to add to my Airbnb listing?

As an Airbnb host, you need to add occupancy taxes to your listing. These taxes vary depending on the location of your property. In some cities, you may also need to add sales taxes or value-added taxes. To find out which taxes you need to add, you can check with your local tax authority or consult a tax professional.

When you add taxes to your Airbnb listing, the taxes will be collected from your guests at the time of booking. The taxes will then be remitted to the appropriate tax authority on your behalf.

How do I add taxes to my Airbnb listing?

To add taxes to your Airbnb listing, go to your Airbnb dashboard and select the listing you want to edit. Then, click on the “Pricing” tab and scroll down to the “Taxes” section. Here, you can add occupancy taxes, sales taxes, or value-added taxes, depending on the requirements of your local tax authority.

Once you have added the taxes to your listing, they will be automatically applied to all future bookings. You can also adjust the taxes at any time by going back to the “Pricing” tab and making changes to the “Taxes” section.

How much should I charge for taxes on my Airbnb listing?

The amount you should charge for taxes on your Airbnb listing depends on the requirements of your local tax authority. Typically, occupancy taxes are a percentage of the rental rate, while sales taxes or value-added taxes are a percentage of the total amount paid by the guest, including cleaning fees and other charges.

To ensure that you are charging the correct amount for taxes, you can check with your local tax authority or consult a tax professional. You can also use Airbnb’s automated tax collection feature, which will calculate and collect the correct amount of taxes on your behalf.

Do I need to collect taxes if I rent out my primary residence on Airbnb?

In some locations, hosts who rent out their primary residence on Airbnb are exempt from collecting occupancy taxes. However, this exemption usually only applies if the host is present during the guest’s stay and the rental period is less than a certain number of days per year.

To find out if you are exempt from collecting occupancy taxes, you can check with your local tax authority or consult a tax professional.

What happens if I don’t add taxes to my Airbnb listing?

If you don’t add taxes to your Airbnb listing, you may be in violation of local tax laws. This could result in fines or penalties from your local tax authority. Additionally, Airbnb may suspend or deactivate your listing until you comply with local tax laws.

To avoid any issues, it’s important to add the required taxes to your Airbnb listing and to keep accurate records of the taxes collected and remitted.

As a professional writer, I know that a strong conclusion is key to leaving a lasting impression on readers. When it comes to adding taxes to your Airbnb listing, it can be a daunting task for many hosts. However, it is an essential step in ensuring that your business is compliant with local tax laws and regulations.

By following the steps outlined in this guide, hosts can easily add taxes to their Airbnb listing and avoid any potential legal issues down the line. It is important to keep in mind that taxes can vary depending on your location and the type of rental you offer. Thus, it is always a good idea to consult with a tax professional for further guidance. Overall, taking the time to add taxes to your Airbnb listing demonstrates your commitment to being a responsible and trustworthy host, and can ultimately lead to a more successful and sustainable rental business.